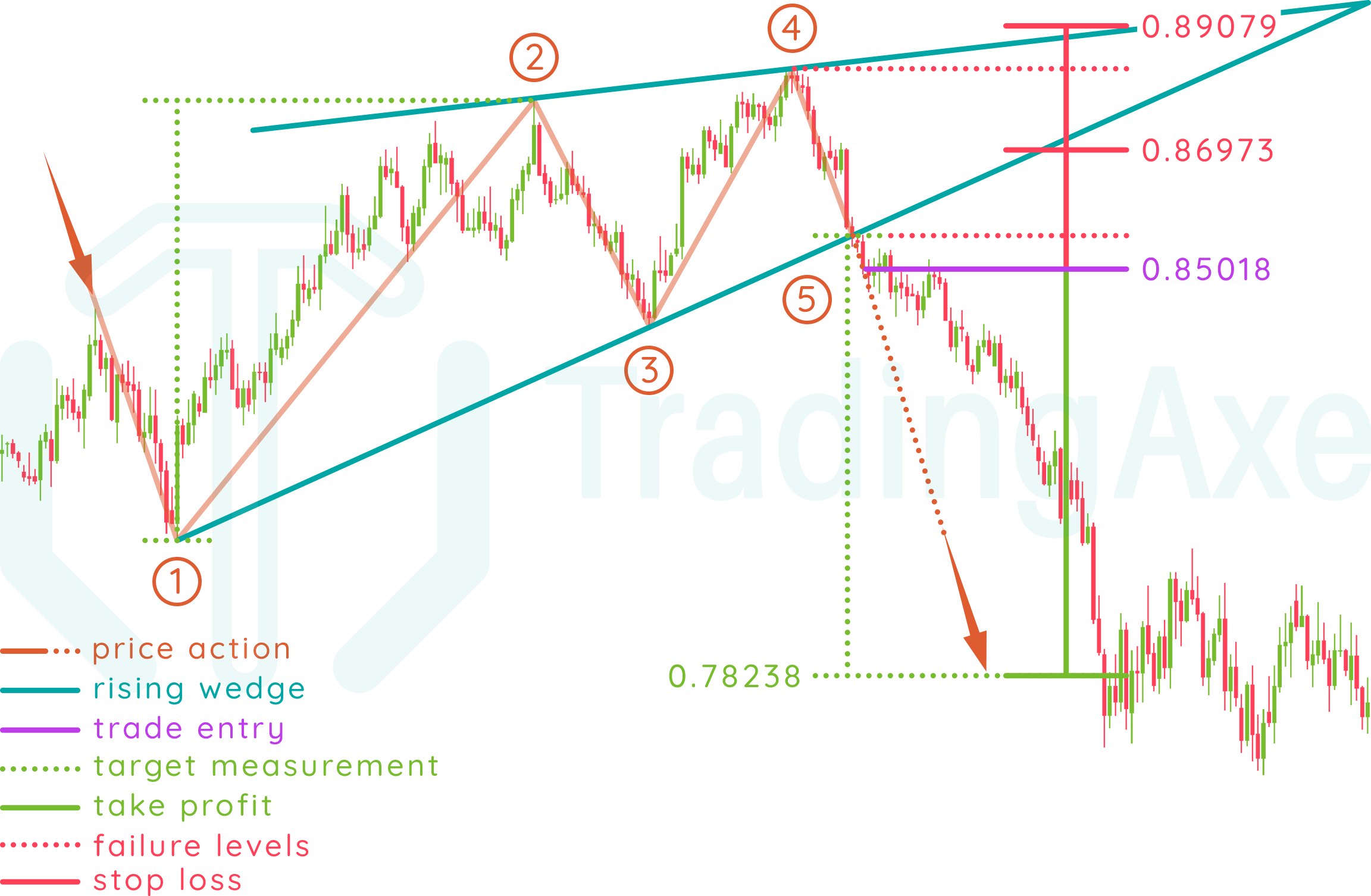

The upper trendline represents the resistance, while the lower line represents support.

Rising wedge pattern in uptrend how to#

How to Identify a Rising Wedge?Ī rising wedge is identified by two converging inclining trendlines on a chart. It should be noted that this pattern does not guarantee a profit. Following a downtrend, the pattern is 51% successful, with an average price decrease of 9%. When the price breaks through resistance, it has an average 38% price increase. How Reliable is a Rising Wedge Pattern?Ī rising wedge stock chart pattern has an 81% success rate on an upside breakout of an existing uptrend. The rising wedge chart pattern is considered a reliably bearish signal, as buyers cannot sustain the uptrend. As sellers become more active, supply starts to outstrip demand, and eventually, a downside breakout occurs, forcing an aggressive price decline averaging 9%. The rising wedge chart pattern occurs when buyers are in control.

Rising Wedge Chart PatternĪuto-detect this Chart Pattern with TradingView What the Rising Wedge Indicates The target was flagged green once the target was achieved. TradingView detected the pattern and set a price target equal to the length of the wedge’s apex. TradingView’s powerful pattern recognition algorithms have autodetected this rising wedge pattern. The target of a rising wedge breakout can be calculated by adding the height of the widest apex of the wedge to the breakout zone.The pattern is more reliable if the wedge is in an uptrend.

The pattern breakout is bearish 60% of the time.The rising wedge has a reliability of 81% in testing 1.A rising wedge can be bearish or bullish or a reversal or continuation pattern, depending on the direction of the price breakout.

Rising wedge pattern in uptrend series#

The result is that prices begin to decline as profit-taking starts to outpace new buyers.Ī rising wedge has two inclining trendlines that connect a series of higher highs and lows. As the price action continues to rise, the trading range tightens, indicating that there is less buying pressure pushing the stock in an upward direction. Traders should be cautious when they see the rising wedge form. This contraction is reflected in the slope of two rising and converging trend lines that are plotted above and below the price action. The rising wedge is formed when a stock’s price rises but, instead of continuing its upward trajectory, it starts to contract as the trading range tightens. The pattern can break out up or down but is primarily considered a bearish pattern.

0 kommentar(er)

0 kommentar(er)